Our Bondora test shows: P2P loans are becoming increasingly popular. Many investors are looking for an alternative investment opportunity in times of low interest rates. The money is in the bank and is losing purchasing power due to inflation. Earning interest on the money in the bank account has long been the measure of all things. But times have changed. Leaving the money in the bank becomes a minus business for the saver. Bondora makes it possible to make the money work for you cleverly. But how good is the provider and how safe is such a system? We clarify these and many other questions in our Bondora test!

Bondora Test: Provider presented

Bondora is a provider of P2P loans. This provider has existed since 2009. Bondora makes it possible to invest in loans from Finland, Estonia and Spain. In addition, this provider offers the very popular alternative for “call money” (GO & GROW), in which you do not have to invest in loans yourself (more on that later). The provider is headquartered in Estonia and is growing at a rapid pace. There are now over 120,000 private investors investing through Bondora. Since the platform has been in existence, more than € 371,8 million has been invested via the platform (as of 11.06.20). The average yield is 10.2% (source: Bondora). That’s what makes the bondora test unavoidable!

Safety

Is Bondora serious?

An average return of more than 10% seems too unrealistic to one investor or another, so it’s no wonder that many do not yet know the offer. In this case, the only thing left to do is to look at the integrity of Bondora.

The P2P provider Bondora is closely monitored in Estonia by the Financial Services Authority (FSA) and has a license. For this reason alone, it is a reputable provider.

Deposit insurance: Bondora works together with the largest Swedish bank (SEB Bank), where the deposit / investments are secured up to € 100,000 according to EU regulations.

Bondora is very transparent and continuously publishes reports that everyone can see. You can see pretty much every statistic. Such as the average rate of return, recovery rate, average interest rates etc. Overall, Bondora is a very reputable provider. Nevertheless, the capital invested is at risk with every investment.

In our research, however, we noticed that Bondora has only been profitable since 2017. On the one hand it is surprising that almost 8 years have been in the red, but not unusual for start-ups, since the initial investment in the financial business is high.

We also find it interesting that the balance sheets that were published were also checked for accuracy by renowned auditing companies, in the case of KPMG (see here).

Return on capital

Basically, Bondora can invest in two ways. On the one hand you have the opportunity to invest the money as in a classic money market account and receives 6.75% credit daily, but can withdraw the money at any time. Or you can invest in loans or loans via the platform itself. This can generate significantly higher interest rates. We look at both options, starting with the popular alternative to overnight money.

Bondora GO & GROW – A Call Money Alternative?

Bondora herself applies GO & GROW as a call money alternative. When you spend your money on GO & GROW, Bondora takes over the decision on which loans the money will ultimately be invested. So you have no options here in contrast to the autoinvest. But you get 6.75% interest and can withdraw the money at any time.

| Bondora GO & GROW overview | |

|---|---|

| Liquidity | Available daily |

| Yield | 6,75% p. a. |

| Risk diversified? | Portfolio very broadly diversified |

| Time needed | Very low |

| Costs | No costs for account. Withdrawal costs 1 € |

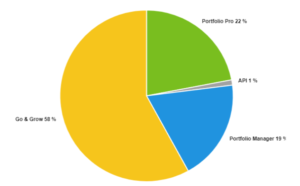

GO & GROW is so popular with Bondora that more than half of its investments are made through Bondora GO & GROW.

Bondora with the Portfolio Pro

On Bondora you can easily invest in loans. The Portfolio Pro is your automatic investment robot. Once set, it invests completely automatically for you.

| Bondora Portfolio Pro | |

|---|---|

| Liquidity | Loans can be sold via secondary market before maturity |

| Return on capital | Depending on attitude and risk between 10-65% |

| Is it possible to diversify widely? | Yes. Tip: invest very small amounts per loan |

| Time needed | Low. Once set, the portfolio runs by itself. |

| Costs | No costs for account. Withdrawal costs 1 € |

User friendliness

The platform is quite simple and allows intuitive use. The visual impression is busier than usual on financial platforms. This is a typical feature of a fintech. These novel financial technologies not only simplify processes, but also strive for intuitive use. Bondora has definitely succeeded.

Support

We tested the support in detail in advance. Also with other P2P offerers we carried out the test. Positively, Bondora noticed. We sent emails with questions and looked, for example, at how long you have to wait for an answer. At Bondora, the time to get in touch averaged 3 days. No other supplier could act as fast. For example, we had to wait for Mintos just under 2 weeks for an answer. The answer you get back in the language in which you wrote the e-mail. In addition, the support answers very detailed and competent.

Often, support for new types of financial products becomes a weak spot, as it does not lag behind the rapidly growing number of users (see incidents at, for example, Bank N26). Therefore, it is commendable that Bondora strives in this regard.

Tip: If you are unsure before signing up with Bondora. Feel free to write to the support if you have further questions and inform you in detail, if you have further questions.

What we found less good is that you have no telephone support and therefore cannot answer your questions acutely.

Fame

Although Bondora is still investing very little in the marketing of the platform, the number of users has been increasing significantly, especially in recent times. To illustrate just how strong growth is, one glance at the evolution of the number of users is sufficient. Last year, Bondora gained nearly 50% new users. More and more savers are discovering this investment opportunity for themselves. For the time being, further strong growth in the coming period is to be expected. P2P loans hold enormous potential, which is far from exhausted.

Bondora registration and first deposit – step by step

Very simple registration in 3 steps:

- Register with Bondora: Either with an email, Facebook or Google Account. If you register via this link there is a 5 € startup bonus. When that’s done, you’ll get a temporary password, which you can use to log in. (Our tip: change the password after the first login)

- Enter data: In the second step you have to complete your account. This includes information such as name, address or, for example, mobile phone number. You will then receive emails, including a confirmation of the registration for the newsletter (which of course you can unsubscribe anytime). Our tip: subscribe to the newsletter which contains a lot of useful information for you as investors!

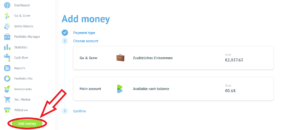

- Strategy and Attitudes: If you decide to pay the money at GO & GROW, then you have nothing to do but to “deposit money” in the left sidebar to kick. Select your desired payment method (eg SEPA) and then select the account “GO & GROW” for the account type.

If your strategy is that you want to invest in part, or even completely in your own loans, then you should use the Portfolio Pro. It provides very precise information on how your money should be invested in loans and is also very easy to set.

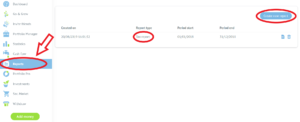

How can you withdraw your money?

The payout from the Bondora GO & GROW account is very liquid. This means that the transfer can be requested immediately and usually takes 1-3 days. With us was the requested money after a day in the checking account.

To withdraw the money, you navigate to “withdraw money”.

Then you select the SEPA transfer and choose how much you want to raise from your Bondora GO & GROW account.

Bondora and Taxes – What to pay attention to?

Attention: Here is the respective law of the country where you have the residence. As an example, the legislation in Germany is listed here.

Tax is the thing quite simple. Legal basis provides the paragraph 44a of the Income Tax Act (EStG) .You have a tax-free allowance of 801 € or with married couples 1602 €. If your income exceeds this limit, then 25 percent withholding tax plus the solidarity surcharge and, if applicable, church tax will be due on the additional income. Thus, with the solos 26.375% plus, if necessary, church tax due.

The platform provides you with all the necessary printouts for the tax office. So you do not have to calculate or document anything yourself.

Bondora test conclusion

P2P loans are not getting more and more popular for nothing. The return and the simplicity of the investment offer savers a pleasant experience. Our Bondora test shows: The concern of the savers to invest the money with a P2P provider is partly justified, but partly unauthorized. It is clear that there is a risk of losing the investment. The precautionary measures taken by Bondora are enormous. So, Bondora’s debt collection process is very efficient and works completely automatically. From debt collection, through court (money order) to bailiffs, at no extra cost to the lender. In addition, with GO & GROW, Bondora offers the ideal alternative for a conservative investor.

We have been using Bondora for a long time. We invest in both GO & GROW and even in lending. Our average net return is around 25%. Although the return fluctuates 24-28% but still it is a fairly high return, but that much of the money is also in GO & GROW with 6.75% interest. If you are interested in our experience with Bondora, click here.