It’s been over 6 months since we started using Bondora. That’s why it’s time to update our Bondora experiences. If you want to assess a P2P platform, the long-term balance is all the more important. So let’s take a look at how our balance sheet has developed after over 6 months of Bondora experience. One thing we can tell you, we are still among the top 100 investors on Bondora.

Current status of revenue

As always, like our Bondora, we have experience with an up-to-date level of revenue.

Our account value is currently 4.784 € and so it is just over 2433 € more than in our last update after 3 months. Since the last update we added 2100 € to the account. In total, we have generated interest of € 248 so far. In the previous update after 3 months it was only 49 € of interest. So in about 3 months after our last update we received 199 € of interest on top.

Bondora Top 100 Investor – XIRR has fallen slightly

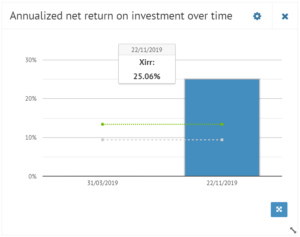

The XIRR (Extended Internal Rate of Return) is the measure that interests us as investors the most. Although the gross yield is just as interesting, it is much more interesting to know how high the actual return is after loan defaults, etc., so the XIRR is a very important measure of the value of the return. In the meantime, our XIRR, that is our net yield, was a whopping 28.36%. In our experience, it is usually after taking out the loans so that they run the first months, above all, quite well and only then sometimes comes to arrears.

Nothing to complain about: Even after 6 months, we are above the 25% and achieve a return of 25.06%. We are very satisfied with that. Our ultimate goal was to achieve more than 20% of the actual return. Surely you can not make that return by using only GO & GROW, which gives you 6.75% interest, but remains fully flexible. Nevertheless, we also use GO & GROW for our portfolio.

Still Top Investor at Bondora

After 4 months, we have already managed to be listed among the top 100 investors for returns on Bondora. What is the development after 6 months? We were able to maintain our position in the top 100 despite the slight decline in the yield. At the moment we are in the 80th position of the investors after yield. Previously, we had managed to finish in 67th place.