Again and again: A bloodbath only happened recently when Bitcoin had already slipped below $ 7,000 several times. The Bitcoin price was even briefly at $ 6600. Ethereum was hit even harder, as the second-placed cryptocurrency by market capitalization scratched the $ 120, although half a year ago the Ethereum exchange rate was almost three times as high.

Bitcoin price development too rapid?

Bitcoin was last half a year as low in price as it was recently (December 17, 2019). The year was relatively positive for many as the Bitcoin price climbed from just under $ 3,500 earlier this year to around $ 13,000, bringing huge profits. When the price continued to drop after that, but fluctuated between $ 7,000 and $ 9,000, many crypto enthusiasts dreamed of a much higher price. One reason that still holds a lot of hope is the upcoming halving of Bitcoin rewards. It should be ready by mid-May 2020. If you believe the philosophy, so far the price has risen with every halving after halving the rewards. Then why does the price drop so much when such a positive event is imminent?

Price manipulation likely to be the reason for the price drop

The halving would undoubtedly lead to a reduced supply and thus probably to an increase in the price. The miners would then ask for higher wages per Bitcoin. However, this is only to be expected after the halving. But why is Bitcoin falling so badly? The answer, as is so often the case in the crypto universe, could be a scam.

This scam is about a whopping $ 2-3 billion in Bitcoin and Ethereum, which are now being cashed out. More specifically, it’s about PlusToken. PlusToken was a Chinese wallet provider and now collected all customer deposits themselves.

*5 € will be given directly after registration and another 5 € will be credited to the account after 30 days if more than 1000 € have been invested.

Chainanalysis research shows: PlusToken fraudsters manipulate the Bitcoin price

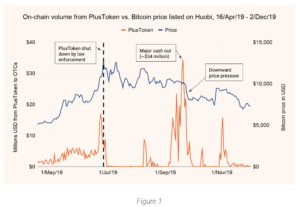

In June of this year, the fraud became known and six people were arrested, but there are said to have been more people involved. Chainalysis has taken a closer look at the scam and comes to the conclusion that the Bitcoin price is extremely likely to be manipulated by these scammers. Chainalysis is a company that specializes in the analysis of blockchain. In a recent report, the company shows the results of the PlusToken investigation.

Quelle: Chainalysis

A total of 45,000 BTC and 800,000 ETH have definitely been transferred to the address of the fraudsters. Chainalysis tracked all transactions and found that the fraudsters had already cashed out 25,000 BTC (around $ 170 million). They used concealment mechanisms such as CoinJoin and paid out the Fiat money through Huobi OTC traders.

Despite the Bitcoin mixer used and the distribution of transactions, Chainalysis was able to prove that the Bitcoin price is massively influenced by the fraudsters.

Based on numerous analyzes, Chainalysis concludes that the fraudsters still have 20,000 BTC ($ 135 million USD) in their possession and may also be cashed out in the near future. So far, the fraudsters have only cashed out 10,000 ethers, leaving a whopping 790,000 ETH ($ 87 million).

Banks see Bitcoin as a revolution in the financial system

What should you do if you read such messages (again)? Answer could be: buy Bitcoin. Yes, right, we would rather buy Bitcoin than sell it. There is no reason why you should sell Bitcoin now.

If you are still worried and do not know what to do, then at least listen to the German banks (exceptionally). Even Deutsche Bank sees enormous potential in Bitcoin. In a recently published report, Deutsche Bank sees a possible Fiat replacement by crypto in 2030. Even a competitor in the sense recognizes the potential of Bitcoin and co. and not without reason.

Still not enough? Another German bank, namely the Bayerische Landesbank, is based on the stock to flow model and estimates a Bitcoin price of $ 90,000 for 2020.

Tip: Always remember why you invested in Bitcoin and whether something serious has changed in Bitcoin itself, which is why you should sell Bitcoin (prematurely). Such price drops are ideal to buy again.

Coinbase currently offers not only $ 10 bonus for buying Bitcoin, but with Coinbase Earn up to $ 152 free cryptos!

Chainalysis’ research would logically explain the price falls, but it is questionable whether this amount of bitcoins can have such a massive impact on the market. Because Bitcoin’s trading volume alone is $ 10-20 billion a day. In addition, the sale was probably exclusively over-the-counter (OTC).

Reason to panic? No, certainly not! It is quite possible that the carnage will continue in the next few days, but we are still very bullish regarding the coming year. There is always turbulence, but the long-term direction is up.