The mega crash at Bitcoin and co. Occurred last week, with Bitcoin at the top losing almost 40% in just one day. Ethereum got it even harder with a 45% loss. These losses come from massive sell-out of investors. The crypto exchanges benefit from this, so Coinbase recorded a record week in terms of trading volume!

Coinbase trading volume breaks record

The corona virus spreads fear and panic among people. These emotions lead to irrational behavior and people sell everything that can be turned into money. So all major stock markets plummeted. Cash is King is the motto right now. But how far will sales go? So far, a correlation between stocks and cryptocurrency has been observed. Will Bitcoin break free and become a crisis currency hoped for by investors? No one can currently answer this. Even gold, the crisis asset par excellence, is losing value. The only thing that is clear is that the corona virus caused one of the biggest Bitcoin price crashes.

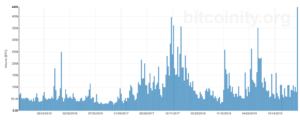

People with fear sell like crazy all their assets and people with cash collect cheap Bitcoin and co. on. One actor benefits above all: The exchange. The trading volume increased enormously due to the massive sales. While most are preparing for another highly volatile week with many question marks, Coinbase can look forward to the rush. According to bitcoinity.org, Coinbase recorded a significantly higher weekly trading volume last week than even at the legendary Bullrun at the end of 2017. No fewer than 440,000 bitcoins were converted in the last week. For comparison, at the end of 2017 there were 397,000 bitcoins, an increase of 10% again!

The strongest increase occurred on March 13, 2020, when 155,000 bitcoins were implemented. The record of December 22, 2017 with 128,000 bitcoins will be replaced.

What’s next?

That is probably the question that concerns most investors. It is impossible to predict the further course because (1) the coronavirus is still poorly researched and (2) as described above, people tend to behave irrationally. This makes it impossible to predict the course or activity in general at Bitcoin.

So far, it has been striking that Bitcoin behaves similarly to the stock markets. Bitcoin is (still) unusable as a crisis currency. Therefore, the benefit is currently lacking. The course is expected to continue to decline. More and more measures are being taken to weaken the economy. National borders are being closed, international air traffic has come to a standstill. In Germany, for example, everything is closed except pharmacies, grocery stores and drugstores.

But there is light in sight: money is being printed like crazy in all major nations to strengthen the economy. The economy can borrow almost zero percent means nothing more than inflation! Bitcoin is the opposite, because it is deflationary. This is where Bitcoin could emerge as a winner after the crisis.

You want to buy Bitcoin?

Tip: If you are signed in to Coinbase, you are also automatically signed in to Coinbase Pro. Coinbase currently offers up to $ 176 in free coins, including Stella, EOS, BAT etc., it is worth taking the coins with Coinbase and making the purchase on Coinbase Pro becuase of the trading fees.

Coinbase* (Fee 1.49% of the transaction amount)

Coinbase Pro* (Taker Fees: 0,05 % up to 0,25 %| Maker Fees: 0,00 % up to 0,15 %)

Binance Jersey* (Fee 0.1% of the transaction amount)

Kraken* (0.16% on purchase and 0.26% on sale)