With Mintos, Bondora is one of the largest P2P credit platforms. Even if Bondora chooses the borrowers very carefully, it can always happen that they do not pay the loan or do not pay it in time. Bondora is characterized above all by the very efficient collection process. We want to examine this debt recovery process in more detail in this article. Bondora has existed for over 10 years and has successfully come through the Corona crisis. So how does Bondora manage the collection process efficiently and set the growth?

Bondora’s Collection & Recovery Process

Even though most borrowers adhere to the loan terms and pay your installments on time, there are occasionally borrowers who fail to meet their obligations or fail to meet them on time. In this case, Bondora operates a 3-stage recovery process. We examine it in detail and see whether it leads to success efficiently.

The recovery process

Before we look at each of the 3 stages of recovery, we note that Bondora sees the goal of the recovery process as reaching Level 3 as quickly as possible.

1st stage: In-house receivables management – 1 to 74 days past due

The recovery of the payment owed is initiated by prompting the debtor to act immediately by email, letter and automated calls. In addition, Bondora forwards the information to the debtor register, who also contacts the debtor. If the debtor does not respond to the reminders, step 2 follows.

2nd stage late payment & court – 75+ days past due

If more than 74 days pass without receipt of the payment owed and the amount includes more than 2 monthly payments, Bondora will classify this loan as “in arrears”.

This is how it looks in practice and is not uncommon:

Once again fully automated, a so-called payment order is submitted immediately after the deadline. The payment order is a very simple, inexpensive and quick process. That’s why most Bondora court cases fall into this category. Only when this efficient process produces no results, or when the borrower files an objection, is the civil action automatically filed, which is significantly more time-consuming. Since a decision is required by the court for this, this process takes at least 4 months until the judgment is final.

Because Bondora offers loans in Spain, Finland and Estonia and the competent court is at the borrower’s place of residence, the processing speed can vary.

3. Bailiff – 200+ days past due

The actual goal of Bondora is reached with level 3. After more than 200 days without receipt of payment and a positive decision by the court, a bailiff is appointed. From this point on, the speed of collection depends on the debtor’s assets and income.

Bondora receives information about the status of the collection process 4 times a year.

Bonus offer: Get € 50 Bondora starting credit!

Our experience with recovery in practice

We have been with Bondora for over a year and can draw precise conclusions about what it looks like in practice with the repayment. So let’s take a look at the statistics of our account. Our strategy when investing is to invest € 1 per loan. This is how we diversify the risk.

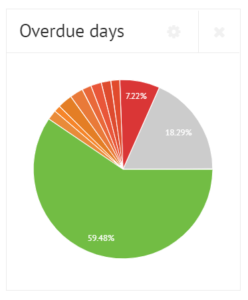

In fact, most borrowers pay on time. With almost 60% of the borrowers, there were no problems, as can be seen from the graph.

The largest part (green) describes the completely unproblematic loans. Then from orange to red are arranged loans that are at least 7 days past due. The more the color changes from orange to red, the longer the loans are overdue. Dark red is about 8% of loans that are more than 180 days past due.

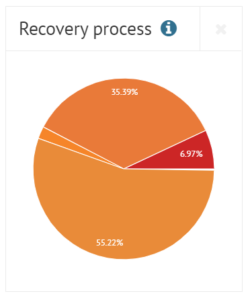

What about the recovery of problematic loans?

Almost 58% are declared as “court – money order”. Followed by just under 33% of the problematic loans already available to the bailiff. About 6.5% are classified as “improbable” and are therefore actually written off. This loan is often about criminal actions. Where a repayment is unlikely. About 2% of the loans are obtained through civil action.

What is the prospect of success for problematic loans?

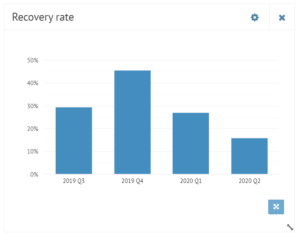

Now we know how the loans are spread over a long period of time. A large part runs without problems. However, around 5-10% of the loans are unclear regarding the repayment. What is the success rate of recovering these loans?

In the statistics presented, the recovery success rate is sorted by quarter. The average rate is around 30%. This means that 30% of the planned recovery is actually achieved. The fourth quarter of 2019 is particularly striking, with almost 50% of the problematic repayments being able to be claimed.

Conclusion

Bondora is a constant P2P lending provider who has been able to collect enormous amounts of data over the years and uses it for credit assessment etc. The almost fully automated 3-step collection process appears to be very efficient and largely effective.

In our experience, it makes sense not only to invest in GO & GROW, but also to use the Portfolio Pro. Even if some loans fail, the return is many times higher. Our current return on Portfolio Pro is around 18% (adjusted return on loan defaults). Whereas the GO & GROW yield is 6.75%.

It can be said that you have to expect loan defaults. Even if Bondora has developed its own working system, it is still possible to stay on some loans. Therefore, you should always spread your risk as widely as possible. It is best to invest in all loan categories (A-HR) and only a few euros per loan.