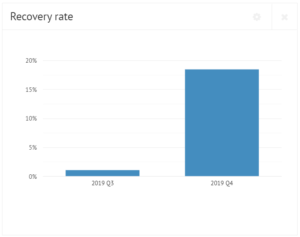

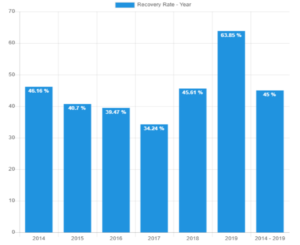

Bondora continues to evolve and become more efficient. Not only the number of investors increases massively also fundamentally data such as the recovery rate increases significantly. Bondora’s loan repayments, that same recovery rate, may be a signal of more confidence in Bondora’s loans.

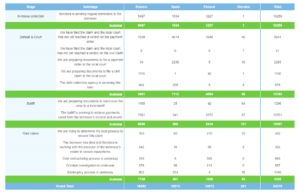

Bailiffs drive 4% more than in the previous month

In October 2019, 42,319 payments were withdrawn, which is around 3.7 percent more than in September. Most of the returns reached the bailiffs with a plus of 4 percent. A total of € 485,274 was confiscated.