Cryptohopper trading bot is a very popular bot for trading cryptocurrencies like Bitcoin, Ethereum, etc. Due to the high demand for the settings, we first wrote an article about the Cryptohopper settings in 2022. However, since further questions about the strategies of the Cryptohopper trading bots have arisen, we are creating this article to provide basic knowledge about the Cryptohopper strategy in 2023.

What is Cryptohopper?

Cryptohopper is a direct algorithmic trading platform with a range of configurable trading features (more on the professional algorithmic trading platform). Cryptohopper’s program is shaped around 5 key elements, which individually have been developed further to meet the needs of traders. The 5 key elements are:

Mirror trading

- This feature enables investors to copy the trades of experienced and prosperous forex investors. Cryptohopper strategies are accessible through a marketplace, some free and some paid.

Paper trading

- A simulated trading method to assess crypto trading bot with real plus live data.

Strategy designer

- A technical indicator assembler that lets traders create their strategies using the listed indicators. There are currently scattered around 130 technical indicators presented by Cryptohopper.

Crypto trading bot Algorithmic trading

- An automated process of executing crypto trading bot with a detailed set of configurations.

Trailing stop

- It’s a piece designed to stop strategies to operate if a set trigger has been pulled.

Attention: Exclusive offer for crypto-invest.io readers

Transaction costs are, besides the costs for the trading bot, the biggest cost factor in trading. If you register with the crypto exchange Binance via our link, you save 5% transaction costs lifetime. The promotion is limited in time.

Which exchanges are approved by Cryptohopper?

There are in total of 12 exchanges that are backed by Cryptohopper. Exchanges are OKEX, HitBTC, Binance, Binance.US, Bitvavo, Kraken, Coinbase Pro, Poloniex, Bittrex, Huobi, Bitfinex, and KuCoin.

How can I trade with Cryptohopper?

Depending on your finesse level and trading experience, traders can use the Cryptohopper platform for their use. Mainly there are 3 types of bots. There are the regular trading bot, the market making bot, and the arbitrage bot. In addition, there are also procedures that can be applied to select a set of indicators to form a strategy. We will explain the main bots in the following.

Regular Trading Bot (Hopper)

The classic trading bot, the so-called hopper, can be configured as required. Here you can include the technical chart analysis, define strategies, or let the bot act on signals.

If you want to know how you can set up the classic trading bot then you can visit our article about the Cryptohopper settings in 2023.

In this article, we’ll take a closer look at the other two trading bots and explain how to build a strategy.

Market Making Bot

The market making crypto trading bot is intended for retail investors (check market creating a bot for professional users). It is meant to perform a liquidity plan to the market of traders’ choice. The market-making crypto trading bot is a configurable algorithm that beheads buy and/or sell (take and/or make) by installing a layered limit of buy and sell orders.

To begin using the market making bot, traders must go through the preceding configurations. It begins with choosing an exchange and setting up the API keys. Even using the API the fund yet will be placed in the exchange and to trade on the exchange, traders require to generate an API key and then relate that to their Cryptohopper account.

After the primary configuration, there is also a collection of more advanced Market Making configuration. Market and Pricing is the next stage of Market Making setup at Cryptohopper. This step includes configuration of the market and which set trader is interested in. Then passing on to the strategy setup with market trends. Market trends hold either uptrend, downtrend or it could stay as neutral. Additionally, the degree sequence of buying and selling with a provided sequence, the order layer which describes the tiered buy and sell orders that are going to be ordered, and then moving on to the cost constraints within layers (e.g. buy amount, higher ask and percentage lower bid).

The Cryptohopper Market trading bot is also equipped with an “Auto-cancel” functionality that is based on the configuration that decides when to open and close positions. There is also an interval limit to trigger the cancel on the bot. The most important specialty of the Auto Cancel is the Cancel on the trend, which allows auto canceling on the bot while the marker changes to a command e.g. from neutral to a downtrend or of neutral to uptrend, etc. Removal on the bot could also be triggered with the rate change, this only happens if the market has a particular defined percentage change or within a given period. The auto-cancel characteristic also works with the depth limit, which Traders can estimate from a minimum of 1 to a maximum of 500. Additionally, Traders that are involved in Cryptohopper Market Making bot can arrange their Stop-loss settings. Stop-loss can be triggered as the result of a turn in the market.

Cryptohopper market making bot also presents a revert and backlog characteristic, where it can pass all the failed orders to the Traders’ backlog. Traders can also return all their canceled orders from the backlog if Traders choose to revert a failed market maker’s orders and re-execute the series. There are many more perspectives on reverting orders that can be automated with configuration, to select the settings, only relapse if it will lead to a profit, or revert/not revert with market trends such as vague trend, downtrend or uptrend.

To reduce down the market making bot, Cryptohopper launched the cool down feature, which the bots cooldowns by eliminating the order after a certain time has passed.

Cryptohopper has devised a dashboard with some widgets for Traders to control the market making bot in action. There is a trading view widget which is a visible representation of the prevailing prices.

Amongst other widgets available on the Cryptohopper dashboard, there are the order list visualizations with the chance of manual Market Making which facilitates buying and selling to be joined and will include that order into the Market Making bot logs.

Cryptohopper also has built an inventory for all failed trades to be collected in a place called a backlog. For Traders to be capable to use the Cryptohopper Market Making bot, they require to be subscribed to the hero hopper Pro kit, which requires a monthly subscription fee of 99$.

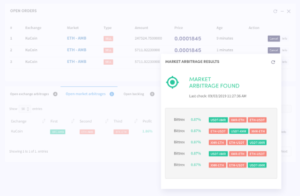

Arbitrage bot

The Arbitrage bot of Cryptohopper is devised to capitalize on variations across different markets/exchanges. The bot enables trade discrepancies in the market, exercising advantage of market-price between the same sets on different exchanges.

Perfectly like the market making bot, the Arbitrage bot also needs a pre-setup method to get going with the bot. The procedure begins with establishing up the maximum open time of all buy orders, which defined the number of minutes a buy order resides accessible before the order is canceled. Following that, there is the highest open time of all sell orders which makes the same thing but for all sell orders.

The setting up procedure later takes traders to exchange settings, where traders should define two exchanges that would prefer to perform their arbitrage. Later, they will set the percentage sell value, which it should utilize to create the sums which are being traded and then the Arbitrage amount per market which how much of trade at a time should take place.

In event interested traders would like to utilize exchange particular configuration, they can set minimum profit that they would choose arbitrage with. Additionally, there are opportunities to have the maximum open time of the Arbitrage. Traders are also given the opportunity to simultaneous arbitrages that define the maximum number of simultaneous or concurrent arbitrages. Moreover, they set a rate on buy and sell which designate the amount the Arbitrage should check.

The Arbitrage dashboard also incorporates a backlog where all failed trades will be saved. The dashboard also has the most advanced Arbitrage trades that were both prosperous and failed. There are also additional widgets inside the Arbitrage dashboard, e.g. exchange arbitrage dashboard issues, the last five trades, and market Arbitrage effects.

Cryptohopper Strategy in 2023

Traders using the Cryptohopper program could build a trading strategy with a collection of indicators they have chosen. These are the signs to buy and sell trades. Cryptohopper has designed a strategy designer characteristic where traders create and custom their strategies. There are three methods trades can appropriate a strategy.

The head is to use Market Strategies, these are policies bought on the Marketplace (we incorporate features of Marketplace later in this article). Strategies bought from Marketplace which could likewise be automatically be renewed every time the seller of the strategy makes modifications to the strategy.

Second is built-in strategies, Cyrptohopper allows a set of built-in strategies that are allowed free of charge. These are slightly basic strategies such as uptrend strategies, buy the dip strategies, Bollinger strategies, etc.

Third and least is My strategies, these are custom made strategies that traders developed.

Cryptohopper Strategy Designer

A strategy designer is a section where traders can personalize their professional analysis setting. There are given a set of indicators where traders can detect and configure a wide variety of trading indicators. Traders on crypto hopper can choose on the chart period, buy and sell signals, and candle time when selecting an indicator. With candle patterns, traders can quickly respond to price changes from the chart data of an exchange.

Main features at a glance

Drag and drop your strategy

With the visual strategy designer you can without much of a stretch simplified your specialized markers unto a total system by simply drag and drop. You don’t need to enter any troublesome codes, yet can simply tap on a pointer, set it for purchase or for sell, arrange it and spare your procedure. For experienced coders there is the likelihood to alter the methodology through JSON however, yet most coders utilize the visual editorial manager to modify their procedures.

Create your own technical analysis

The strategy designer has more than 130+ indicators and candle patterns to choose. Make your own specialized examination to get the best purchase and sell signals from your procedure. Famous indicators and candle examples are: RSI, EMA, Parabolic Sar, CCI, Hammer, Hanged Man, however Cryptohopper has some more.

Test your strategy in the strategy designer

One of the greatest things is that you can test your strategy in the Strategy Designer or load into the backtesting tool By this way you will see if the bot generates buy/sell signals like expected or not. Tip: Use the paper trading to test your strategy! This way you don’t risk any funds.

Moreover, traders can create their strategies by adding a JSON code, this part is designed for more technical and programmer traders. These traders could also change existing strategies. Once policies are configured and up and running, the Cryptohopper strategy dashboard enables traders to control their strategies.

Cryptohopper Marketplace

The marketplace is a division within the strategy creation method. This unit is intended solely for social and mirror trading. This is where traders with a normally lower level of experience and expertise in trading can browse already created strategies and utilize it for their funds to invest with.

There is a collection of strategies and templates accessible in the marketplace. Each template and strategy has a similar base-currency and exchange. Since templates can be determined based on the trader’s preferences. Additionally, all templates know their ratings, total downloads, changes, and recentness.

The marketplace likewise consists of Signalers. All signs in the marketplace compared to an exchange. A trader can configure their trading utilizing only signals. The Signal configuration could restrict orders. The setting also enables traders to take profit with a negotiated percentage set.

Strategy statistics

Cryptohopper gives traders with a collection of statistics for traders to be able to observe the performance of their strategies and trades. There is a kind of ways presented in the statistics dashboard to see how trades and strategies are working.

The time for all buy and sell orders, allocation of funds based on money, open positions, and base currency owned. Traders can view their advantage stats basing on currency invested on, base currency returns, the foundation currency gained/lost in current positions, and trading prices paid.

Profit based on sell triggers is added statistic available for traders to monitor profit associated with percentage profit, trailing stop loss, and auto confined within time. Traders can also view profits based on buy triggers that we created by strategies, signalers, tracing stop buy.

Cryptohopper Features

- Functionality – Cryptohopper works as a web-based solution, and features a simple to use and intuitive user interface that covers a wide range of functions. Users can configure the crypto trading bot to purchase automatically 24/7 and gain the use of both algorithmic and social trading. Cryptohopper Trading strategies can be obtained via several technical indicators or by heeding the actions of third party trading experts.

- Technology – The semi-automated trading takes place via API alliance with a variety of cryptocurrency exchanges and the service can be employed on any device attached to the internet such as a desktop, laptop, tablet, or mobile phone.

- Range of Tools – The platform offers a good variety of trading tools and consolidates features such as a bot backtesting tool, saveable templates, configurable trailing stops, and customizable technical symbols.

- Exchange Integration – Cryptohopper is currently fit with nine exchanges including Binance, Bittrex, Bitfinex, Coinbase Pro, Huobi, Cryptopia, Kraken, Kucoin, and Poloniex. Guide for BitFlyer, CEX.IO, Bitstamp, Cobinhood, and HitBTC is programmed to arrive soon.

- Customer Support – The platform combines a support team that is ready to deal with any issues. Users can communicate the team by offering a support ticket in the Support Section, and they can also be reached via their Twitter account, Telegram group, and Facebook The website also includes several FAQs in the Support Section, as well as several Tutorials that encourage users to navigate the platform.

Cryptohopper Academy

For traders who would want to be familiar with Cryptohopper as a trading stage, there is a tutorial-like instruction approved by Cryptohopper itself and other professors can also use this academy portal to provide educational information to interested traders.

Our Cryptohopper strategy conclusion

Cryptohopper has done a satisfactory job working out a mechanism that traders would feel useful doing their trades. We loved the interface and how they have created a user journey that would fit a different type of traders with various levels of expertise. The style in the platform is well informative and hints around important characteristics. Though, as a solution provider for expert crypto market makers, we understand the assessment of market trends is done manually by users and very susceptible to human error. The market-making bot has a low capacity to manage more markets at once and wants content human supervision.