There are now many ways to invest his money in today’s time profitable. Popular asset classes for lucrative profits are, for example, cryptocurrency or sovereign P2P platforms. In today’s post we would like to share our experience with the largest P2P platform Bondora. We extensively tested Bondora during this period (support, different investment strategies, valuation of interest received and unpaid capital and so on).

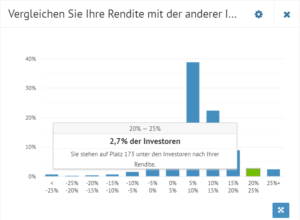

There is a big surprise that really astonished us. You wonder what’s so exciting about it? You will find out right away, but one thing in advance our investment strategy has made us one of the platform’s top investors! We will show you in detail our Bondora experiences.

Current status of revenue

We first paid in 500 € and experimented a lot to understand the platform in the best possible way. We also tried to withdraw money (which went smoothly). Over time, we have invested more and more money (now over 2000 €).

This is what our current balance sheet looks like:

As you can see, the graphics are unfortunately in German, but we simply forgot to change the language for the screenshot. Please forgive us (:D). We still tell you the statistics.

So we have already received a whopping 50 € interest! That pleases the investor heart. Considering that we have invested € 1000 in Bondora GO & GROW, the gross yield of 36.7% is very solid!

Since we also want to give you a transparent insight, we show you an exclusive insight into our statistics and the strategy of our Bondora test!

On the screenshot you can see that our gross yield is just over 36%. But what is the gross return, the net return is much more crucial or?

Net return at a whopping 34%!

First of all, what is a good net return? This question is certainly answered quite subjectively. Many are happy when they generate a net return of 8%, for example, with the help of buyback guarantees on various platforms. We are not so amused about buyback guarantees! Why is it not the yellow from the egg? As an investor, you waive an additional risk premium that is much higher than the risk itself! That’s why we ourselves have a net return of over 34%!

Moreover the fear that most investors have is that loans could fail. Of course, nothing is certain, but we and many other long-term investors have found that very rarely a loan does really fail. Please take a look at the statistics on Bondora itself! In our experience, there are on average 2 loans of 1000 that really cause problems. But is it a reason for us to worry? No! Bondora is very consistent and immediately initiates all necessary measures. From debt collection to the court, if one does not want to pay despite everything. Thus, perhaps 1 loan of 1000 fails. This is almost negligible for us!

By the way: Since the last incident at Mintos, many realize that buyback guarantee guarantees nothing. The incident we are talking about is Aforti Finance and its default on the loan repayment on the Mintos platform. So let’s summarize: You get a (supposed) buyback guarantee and you can then be happy about 11-12% interest? All right, we’ll be happy to continue with Bondora and waive a repurchase guarantee, but get the 3-fold net interest ;).

We are # 173 of the best investors on Bondora!

We will soon report on our investment strategy for such a return and give you as always a concrete insight!

Passive income slow but steady

Our goal is to build a stable passive income with P2P Investment. Right now we are on a good way. meanwhile, our monthly income from Bondora is just over € 40. Goal will be 1000 € per month!

Conclusion

Not only are we satisfied, we are very happy with the development of the portfolio. For us another reason to give the platform more confidence and invest significantly more money. Our Bondora experience after 3 months could not have been better. The long trial and error of investing with the Portfolio Pro seems to have paid off. Of course we will keep you up to date and will continue to document our development for you.

Nevertheless, we would like to mention that the investment still remains risky. While it is a very lucrative, if not the most lucrative, investment method currently, it also remains risky. So invest the money wisely!