Cryptocurrencies are springing up like weeds and every project thinks it’s unique. But no matter how serious the projects are, they have one thing in common: the crypto trilemma problem. The trilemma problem is the linchpin of the success of cryptocurrencies. It is therefore important to explain this in more detail.

Blockchain trilemma

Blockchain is used synonymously with cryptocurrencies here because the cryptocurrency projects are based on the blockchain.

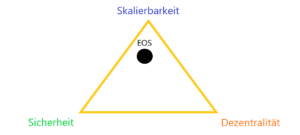

A trilemma means choosing from three options. In the case of the blockchain, the three options are: scalability, decentralization and security. The trilemma is that there is a trade-off between the options. That means: If you want to achieve as much of one option as possible, it will be at the expense of the other option.

These three options are the main features of the blockchain, but it is not possible to maximize all three options (so far), which is why the whole thing can be represented very well in a triangle. Vitalik Buterin (co-founder of Ethereum) once said that a blockchain can have a maximum of two of these three options. For example, although Bitcoin is decentralized and therefore also relatively secure, scalability suffers enormously. So the Bitcoin network can only process 7 transactions per second. If Bitcoin wants to become a means of payment at some point, scalability must increase significantly. For example, VISA manages about 45,000 TPS,

If you would now want to classify a project in this triangle, you quickly realize that you cannot do all the options possible. You can also understand what Buterin meant by his statement.

For example Bitcoin

Bitcoin is relatively secure and decentralized. There are many network participants and they are spread all over the world. While Bitcoin is not as decentralized as is often believed because few mining pools can have a huge impact on the network, it is still the most decentralized cryptocurrency at the moment. Every new transaction must be checked by the entire network. This is exactly why the blockchain behind Bitcoin is very secure. But again very lame, because checking every transaction is very resource-intensive. Bitcoin thus gains in decentralization and security and is enormously lagging behind in terms of scalability.

For example EOS

EOS is relatively scalable and reaches around 3000 TPS, but it is anything but decentralized. In June 2019 Weiss Crypto Rating downgraded EOS in the rating due to increasing centrality. EOS seems to favor network participants who hold a large amount of EOS. The security is therefore lower than with Bitcoin.

The solution to the blockchain trilemma problem

Probably the biggest challenge for blockchain is the harmony between the three options and maximizing all options at the same time.

In order to solve the scaling problem with a given decentralization, solution concepts such as the Lightning Network or Sharding seem to be a possibility of the solution. In sharding, what is being discussed at Ethereum, the transactions are validated by a certain group and not by the entire network. Lightning Network, on the other hand, could make Bitcoin more accepted, because it enables the famous “coffee purchase”. Since microtransactions can also be sent directly.

IOTA, for example, does not use the conventional blockchain, but the so-called tangle. IOTA has a high scaling, but the decentralization is criticized. A so-called coordinator ensures security, but is to be abolished. One eagerly awaits the successful introduction of Coordicide. Accordingly, IOTA would become decentralized and maintain the high scaling. It is questionable whether this will succeed. If it succeeds, IOTA would have a unique selling point.