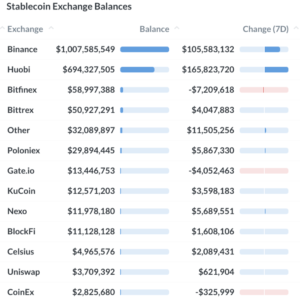

However, a crucial crypto exchange is missing from this list: Coinbase. When asked about this, the data scientist replied that it is currently difficult to obtain the data from Coinbase due to the complex structure. However, he would deliver these on occasion.

You can also see the trend on other exchanges. The value of stablecoins on most of the exchanges presented increases, which in turn confirms the trend that many investors are waiting on the sidelines. So it depends on how these investors decide. Will the holdings be paid out in Fiat money or will a large part be exchanged for Bitcoin again?

It is only an indication, but you should see the signs to be able to assess the general mood on the crypto market. Everyone is waiting for the turning point now, but the question is does this point come at all and if so when is it? Many small indications can give an overall picture of the market.

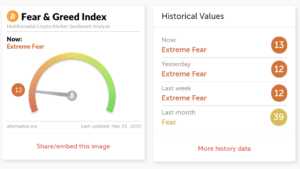

Anxious mood on the crypto market

As expected, the mood on the market is currently “very fearful”, at least that is indicated by the Fear-and-Greed Index.

The entire crypto market is analyzed and the current mood is reflected in the index. The lower the index, the more fearful people are. The higher the index, the more greedy people are. The index goes from 0 to 100. Currently the index is 13 points. So it could be a good place to buy bitcoin.

<span class="su-quote-cite">Warren Buffet</span>

Investors take a defensive position

Due to the current situation, the outcome of which appears uncertain, most investors are unsettled. Cash is still the measure of all things. Despite the massive flood of money, there is even fear of deflation. Everything is exchanged for fiat money. The demand for Fiat money is big and the supply apparently not big enough, despite the new money.

There will come a time when the scenario tips over and a lot of money is reinvested in assets. But since nobody knows when it will happen, many sit out the current situation. Crypto investors seem to be strongly oriented towards the stock market. Because the correlation between the stock market and Bitcoin, about which we have already reported, seems to be continuing. As soon as the stock market reacts positively, the crypto market follows with a slight delay with the same reaction.

Interest to buy Bitcoin is increasing

A lot of money was pulled out of the crypto market. But the signs are good that Bitcoin will recover from it. As we reported last, the interest to buy Bitcoin is now increasing enormously. Especially in Germany it is higher than it has been for over 2 years. Added to this is the current monetary policy. A lot of cheap money and more is being added. Bitcoin could hedge against this. The value of money will decrease over time, at some point the large amount of new money will create an oversupply and inflation will follow. Gold is particularly popular in such phases as a hedge or to preserve value. Therefore, Bitcoin could also benefit during this time and gain significantly in value.

The lot of new money will definitely be spread across cryptocurrencies sooner or later. The Bitcoin course is fueled by the upcoming halving, which is no longer 30 days away. After that, the amount of bitcoins that come into circulation is halved.

You want to buy Bitcoin?

Tip: If you are signed in to Coinbase, you are also automatically signed in to Coinbase Pro. Coinbase currently offers up to $ 176 in free coins, including Stella, EOS, BAT etc., it is worth taking the coins with Coinbase and making the purchase on Coinbase Pro becuase of the trading fees.

Coinbase* (Fee 1.49% of the transaction amount)

Coinbase Pro* (Taker Fees: 0,05 % up to 0,25 %| Maker Fees: 0,00 % up to 0,15 %)

Binance Jersey* (Fee 0.1% of the transaction amount)

Kraken* (0.16% on purchase and 0.26% on sale)